Warner Bros. Discovery and Paramount Global are in talks for a potential merger, IndieWire has confirmed. It’s the very early days — especially considering WBD is in an M&A timeout until April.

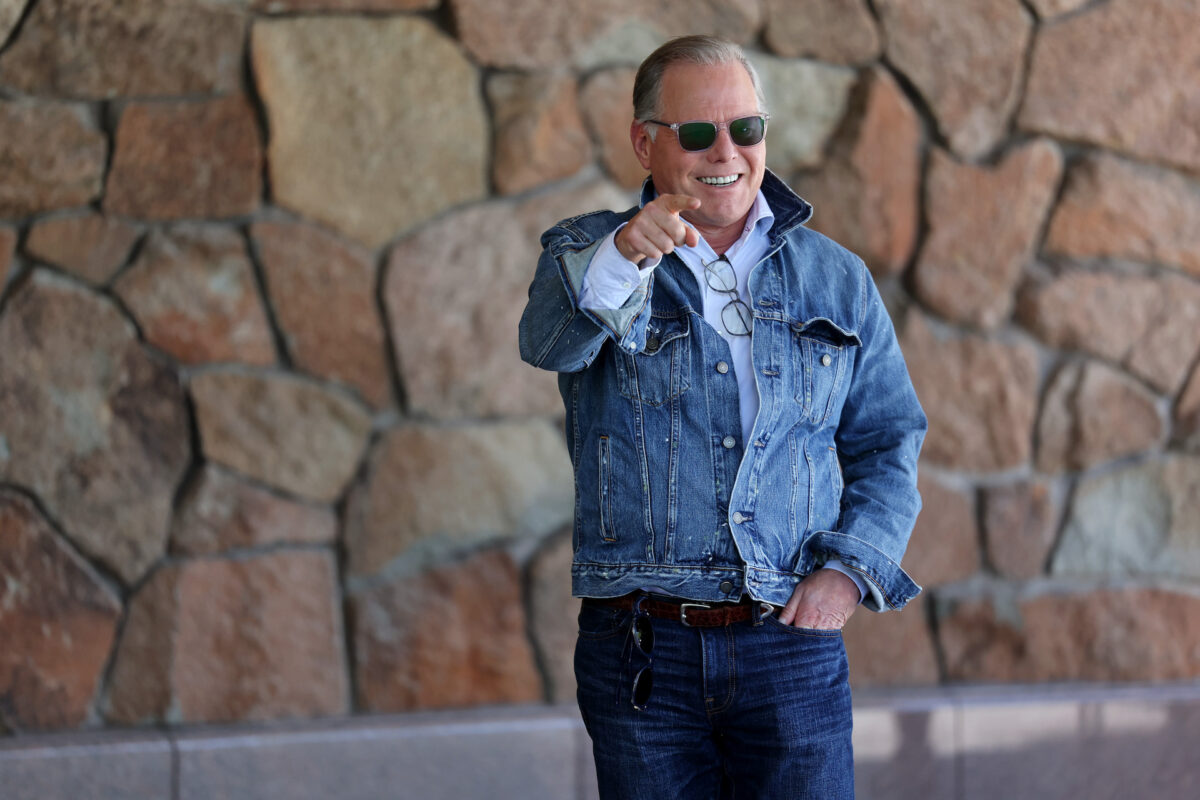

As Axios first reported, Warner Bros. Discovery chief David Zaslav journeyed to the Paramount offices in Times Square for an hours-long meeting on Tuesday with Paramount CEO Bob Bakish. Rumor has it they were not there to reminisce about the “TRL” days.

He and Bakish discussed potential synergies between their two companies, including how Max — itself the combination of Discovery+ and HBO Max — could complement Paramount+ (now with Showtime!). There are also possibilities within each company’s news, sports, and kids programming — plus, HBO and Showtime could stop competing with each other and join forces. (Not that it’s been much of a competition lately.)

Zaslav has also spoken with Paramount Global’s controlling shareholder Shari Redstone about a potential deal.

Reps for Warner Bros. Discovery declined comment to IndieWire; a spokesperson for Paramount Global did not immediately respond.

“The strategy being considered mirrors Zaslav’s blueprint for prior mergers,” Axios wrote. Before the 2022 Discovery, Inc. and WarnerMedia combination, Zaslav brought Scripps networks, like HGTV and Food Network, under his Discovery umbrella.

The two options on the table: WBD 1) buying Redstone’s National Amusements, Inc. (NAI), which holds 77 percent of Paramount Global’s voting shares, or 2) just buying the much larger (compared with NAI) Paramount Global outright. (The Redstone trust only owns a 10 percent equity stake in Paramount Global.) Warner Bros. Discovery has already hired bankers to explore a potential deal.

Zaslav is not the only potential Shari suitor: David Ellison and Skydance have also recently held their own exploratory talks about acquiring NAI. The Redstone family has famously been against selling actual Paramount (fka ViacomCBS) since patriarch Sumner Redstone’s days; clearly, that stance has softened.

WBD ended the September quarter with about 95 million overall streaming subscribers, mostly — but not entirely — from Max. Paramount+ had about 63 million subs. Another key difference: Max turned a profit this year, Paramount+ (fka CBS All Access) has yet to make money.

Paramount needs a life raft, and a Warner Bros. Discovery takeover is more likely to receive regulatory approval from an M&A-averse government than another option, like Comcast. Paramount Global owns CBS, and Comcast owns NBC; the FCC has a two-network rule that would disallow two broadcast channels under the same roof.

NBCUniversal’s own streaming service, Peacock, currently has 30 million paid subscribers. It could use a hand there, and Comcast has the cash — a merger scenario there would likely require the spinning off and sale of CBS. Comcast is multiples larger than Warner Bros. Discovery and Paramount — and it still would be even if the two chatterboxes combined.

Most other buyers would primarily, if not exclusively, be interested in Paramount Global for its Paramount Pictures studio. (Many would immediately shutter Paramount+ to stop the bleeding.) A combination of the Warner Bros. and Paramount libraries would immediately be the gold standard; owning two old Hollywood lots would be pretty cool, too.

Paramount has not-so-quietly been preparing for this moment. For years, Bakish has practically waved a “For Sale” sign, and last month, Paramount Global updated its senior leadership’s golden parachutes in the case of acquisition. If Paramount gets bought out and Bakish is ousted within the first two years, he now stands to receive $50 million — plus benefits.

Zaslav may be the man who makes Bakish rich(er); he’s also the guy who has regularly been rubbing creatives the wrong way. Killing off “Batgirl” last year for tax purposes was a particularly unpopular move that placed Zas directly in the crosshairs of picketing writers and actors. The blowback didn’t leave a lasting impression — Warner Bros. pulled pretty much the same thing this year with “Coyote vs. Acme.”