Radio broadcaster Audacy has begun talks with its lenders to restructure the company’s debt as a soft advertising market clouds its long-term outlook.

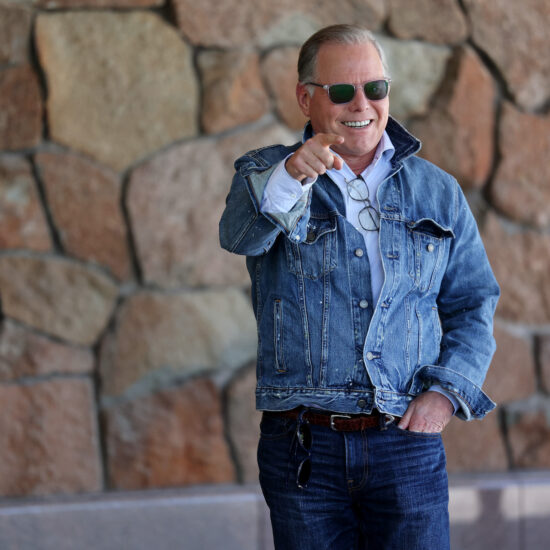

The discussions, first reported by the Wall Street Journal, follow the May 10 statement by chairman/president/CEO David Field during the company’s first quarter earnings call that Audacy was “finalizing its preparation to commence discussion with its lenders to explore the financing and strategies to manage” its debt load.

“As we have previously stated we intended to do, we have initiated discussions with our lenders to refinance our debt and optimize our balance sheet to position Audacy for long-term growth as we continue to invest in our people, platform, technology, content and growth initiatives,” the company said in a statement to Billboard.

Audacy warned in a May 10 10-Q filing that “challenging macroeconomic conditions” such as interest rates and soft advertising revenue had created “significant uncertainty in operations.” Field said during the earnings call that Audacy’s banks “have historically been willing to amend covenants to provide relief during recessionary periods” but added “there can be no assurance” the banks would do so in these negotiations.

A weak advertising market has required Audacy and other radio companies to cut costs, sell non-core assets and lay off some employees. Audacy’s first quarter net revenue of $259.6 million was down 5.7% year-over-year and 16% lower than the same period in 2019. The downturn only amplifies the strain of Audacy’s debt load. “The number one issue is too much debt in a secular declining industry,” Craig Huber, media analyst at Huber Research Partners, told Billboard in May.

Most of Audacy’s $1.88 billion of long-term debt came from its 2017 merger with CBS Radio. The deal increased Audacy’s revenue more than four-fold but also increased its debt from $468 million at the end of 2016 to $1.86 billion at the end of 2017. As of March 31, the company was in compliance with its debt covenants, according to its latest 10-Q filing. But Audacy warned investors that its forecasted revenue for the next 12 months “is unlikely to be sufficient” to maintain compliance with its covenants. Failing to meet those covenants would put the company in default and require waivers or amendments from lenders.