Some Disney investors aren’t exactly sailing on the company’s announcement that it plans to spend $60 billion on parks (and cruises), experiences, and consumer products over the next decade. That’s nearly twice what Disney spent on the segment over the prior 10 years.

Disney shared its plan Tuesday at its annual Investor Day; an accompanying 8-K report was filed with the SEC. It said Disney plans on “investing in expanding and enhancing domestic and international parks and cruise line capacity, prioritizing projects anticipated to generate strong returns, consistent with the Company’s continuing approach to allocate capital in a disciplined and balanced manner.”

The money will come from the company’s piggy bank as well as “other liquid assets, operating cash flows, access to capital markets and borrowing capacity under current bank facilities,” the filing continues.

Cool, cool, cool — but what about the ROI? That’s the question that left Investor Day attendees “a bit frustrated,” Wells Fargo’s lead equity analyst Steven Cahall wrote in a Wednesday morning note to clients (obtained by IndieWire).

“The spending guidance is out there, but it’s unclear if Parks earnings growth should accelerate alongside spending growth,” he said.

Hopefully it does. Without an increase in earnings, a drastic increase in spending will eat into free cash flow. And Wall Street, especially these days, doesn’t like to see that. It’s why shares in Disney (DIS) have dropped from $84.92 on Monday night to as low as $81.80 this morning. The Wells Fargo price target for Disney’s stock remains unchanged at $110 per share.

Why so high (relative to the market)? Cahall (still) believes Disney’s content is under-monetized in its direct-to-consumer (DTC, or streaming) business “given the valuable library and relatively low ARPU on Disney+ and Hulu.” As of July 1, the average revenue per user for Disney+ was $6.58 per month ($7.31 in the U.S. and Canada); for Hulu, it was $12.39/month. At the time, the core Disney+ service (not India’s Hotstar) had 105.7 million users (46 million in the U.S. and Canada); Hulu had 44 million.

In terms of revenue, Disney’s media and entertainment distribution (DMED, internally) is still nearly twice the size of its parks, experiences, and products (DPEP). But in terms of actual profit, the opposite is true. And it is the latter segment that has been surging as of late — especially at the international parks — while linear-television (broadcast and cable) woes and large investments in streaming have weighed the content side down.

One experience that definitely didn’t work out was the Star Wars: Galactic Starcruiser hotel, an ambitious and expensive project for which Disney took a $250 million hit in what executives referred to as “accelerated depreciation.” The resort was open for only one year before shuttering due to a lack of fan interest. (Really, it was a lack of fans who were willing to part with $5,000 — or more — for a two-night stay.)

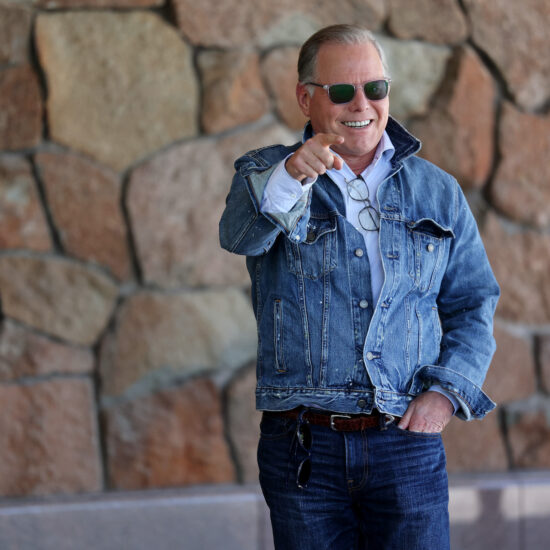

Cahall, who was in attendance in Orlando, foresees Disney+ being “profitable earlier and more strongly than consensus.” He was swayed by Disney CEO Bob Iger’s emphasis on a “renewed focus on IP improvement,” which is the whole game when it comes to the Walt Disney Company — both in terms of parks and video content.