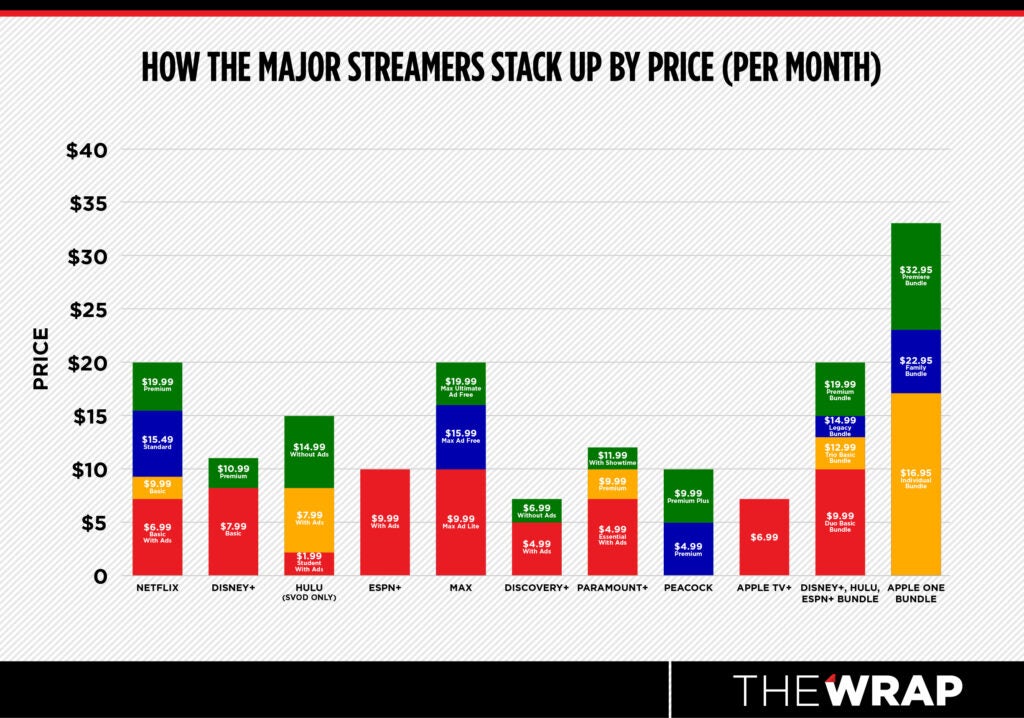

With Max introducing a new premium tier at $19.99 per month, the trend in SVOD pricing continues upward, which makes attracting and retaining customers that much more of a challenge

Could prices go up from here? “Even the priciest tiers of many [streaming services] can be considered underpriced. It’s still generally cheaper to pay for one month of a major streaming service than to make a trip to the movies, for example,” Morning Consult entertainment and media analyst Kevin Tran told TheWrap.

Still, Max and its money-losing competition must thread the needle between charging a premium for what they view as valuable content, convincing consumers to pay up without heavy discounting or expensive marketing and growing their direct-to-consumer businesses to a scale where, like Netflix, they can start spinning out Wall Street-pleasing profits. It’s a tough challenge, especially as subscribers are showing signs of fatigue.

Subscriptions are hopping, but not in a good way

Around half of consumers say they pay too much for the subscription video on demand (SVOD) services they use and about a third intend to reduce their number of entertainment subscriptions, according to a new Deloitte survey on digital media trends released Monday. The consulting firm polled 2,020 U.S. consumers ages 14 and older.

Subscriber churn for paid services during a six-month period is around 40%, the survey noted. For Gen Z and Millennial consumers, those numbers jump to 57% and 62%, respectively. Nearly 45% of Millennials have “churned and returned” with a paid SVOD service, cancelling a paid subscription only to renew that same subscription within a six-month period.

According to Parks Associates, 36% of over-the-top streaming subscribers, or 32 million households, are “service hoppers.” Other analysts call the behavior “subscription cycling.” These customers tend to stay with services for a shorter time, have more subscriptions at a time and have canceled more services than other subscribers over the previous 12 months.

Around half of consumers, or 47%, surveyed by Deloitte said they have made at least one change to their entertainment subscriptions because of current economic conditions, such as cancelling a paid service to save money, switching to a free ad-supported version of a service or bundling services. Millennials are most likely to do so, perhaps because they spend more than any other generation on paid streaming video services — an average of $54 per month, compared to the overall average of $48 per month.

Deloitte noted that around 60% of households are now using a free, ad-supported streaming video service (FAST), and around 45% say they watch more ad-supported streaming video services than they did a year ago, whether paid or free.

“With so many options for entertainment, streaming providers should fight harder to retain subscribers and deliver more variety and value,” Kevin Westcott, the leader of Deloitte’s U.S. technology, media and telecom practice, said in a statement. “Streamers are under pressure to reinforce their core offerings, but they should also be leveraging gaming and social media, especially considering the behaviors we are seeing in younger generations.”

Max’s Ultimate Ad Free tier comes in at the same price as Netflix’s Premium tier, which offers unlimited ad-free movies, TV shows, mobile games, Ultra HD, spatial audio and the ability to watch content on up to four devices at a time and download on up to six devices at a time. The new Max offering also matches the price of Disney’s Bundle Trio Premium, which offers ad-free Disney+ and Hulu and ad-supported ESPN+. Cheaper tiers, at $15.99 a month without ads or $9.99 with ads, carry forward HBO Max’s pricing, though the middle tier no longer includes 4K streams.

Priced just above Max’s Ultimate Ad Free Tier is the $22.95 per month Family and $32.95 per month Premiere Apple One bundles, which can be shared with up to five people and includes Apple TV+, Apple Music and Apple Arcade. The Apple One Family plan also includes 200 gigabytes of storage through iCloud+, while the Premiere plans includes 2 terabytes of storage, News+ and Fitness+ — highlighting the sophisticated bundles that players from outside media can bring to streaming.

The Max Ad Free tier sits slightly above Netflix’s standard tier ($15.49 per month), Hulu without ads ($14.99 per month), Paramount+ With Showtime ($11.99 per month) and Disney+ Premium ($10.99 per month). Max’s Ad Lite Tier is priced similarly to Netflix’s Basic tier, Paramount+ Premium and standalone ESPN+.

WBD is hedging its pricing bets by keeping Discovery+ as a cheaper standalone service, still costing $4.99 per month with ads and $6.99 per month without ads. In addition, the company will launch its own FAST service later this year.

The cost of content

For years, the thinking has been that new content draws in subscribers. And that content costs a lot of money, which puts upward pressure on subscription pricing.

“Consumer subscriptions are largely driven by content, and streaming services are investing heavily on archive and rerun content rights, as well as spending billions of dollars on developing new original content,” Parks Associates president and chief marketing officer Elizabeth Parks told TheWrap. “Increased investment in original content is pushing up subscription service rates.”

There are signs that the content arms race may be peaking, though. In January, Ampere Analysis predicted that Warner Bros. Discovery and Disney would overtake Comcast and its subsidiaries to become the leading investors in original content in 2023, with Disney estimated to reach $10.5 billion and Warner estimated to exceed $9.5 billion. The research firm noted that Netflix will continue to lead direct SVOD spend, contributing over 25% of global SVOD original content investment.

“SVOD services will still see an increase in total content investment in 2023 but a lesser 8% year-on-year growth compared to 25% in 2022,” Ampere Analysis research manager Hannah Walsh said.

Analysts at MoffettNathanson estimate that HBO Max’s original content output fell from 15 seasons in the fourth quarter of 2022 to just nine seasons in the first quarter of 2023, a significant step down from this time last year when the service released 22 original new seasons.

But Max is upping the ante: It will feature fresh content regularly with an average of more than 40 new titles and seasons every month, the company said. New projects announced during the streaming event include a Harry Potter TV series expected to last for 10 years, a “Game of Thrones” prequel, a “Big Bang Theory” spinoff, a “Conjuring” drama series, “True Detective: Night Country,” “The Regime” and “The Sympathizer” and more.

The era of unrestrained spending and cheaper subscription pricing may be nearing an end, though. “Most of the streamers that launched in late 2019 and early 2020 purposely came in at aggressively lower prices to quickly build subscriber bases that they could eventually upcharge, such as Disney+ and Apple TV+ which raised prices in late 2022,” Morning Consult’s Tran said.

He warned that Netflix will have to be more cautious with price increases moving forward, citing its “already quite costly” premium tier, but he expects prices for the ad-free tiers of all the major streaming services to steadily climb in the coming years to help fund content development and boost profitability.

Ian Greenblatt, the managing director of J.D. Power’s technology, media and telecom practice, said that it’s too soon to tell how the Max relaunch will impact subscribers and churn.

“Longer-term, it comes back to how much value consumers perceive from the new options and how sensitive to any price increases they become,” he told TheWrap. “It’s certainly a key area to watch in the months ahead.”

- timewarnerent.comhttps://timewarnerent.com/author/gleberman1236/

- timewarnerent.comhttps://timewarnerent.com/author/gleberman1236/

- timewarnerent.comhttps://timewarnerent.com/author/gleberman1236/

- timewarnerent.comhttps://timewarnerent.com/author/gleberman1236/