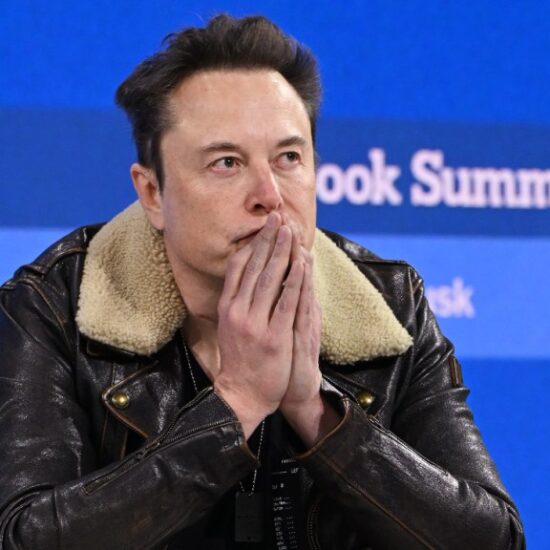

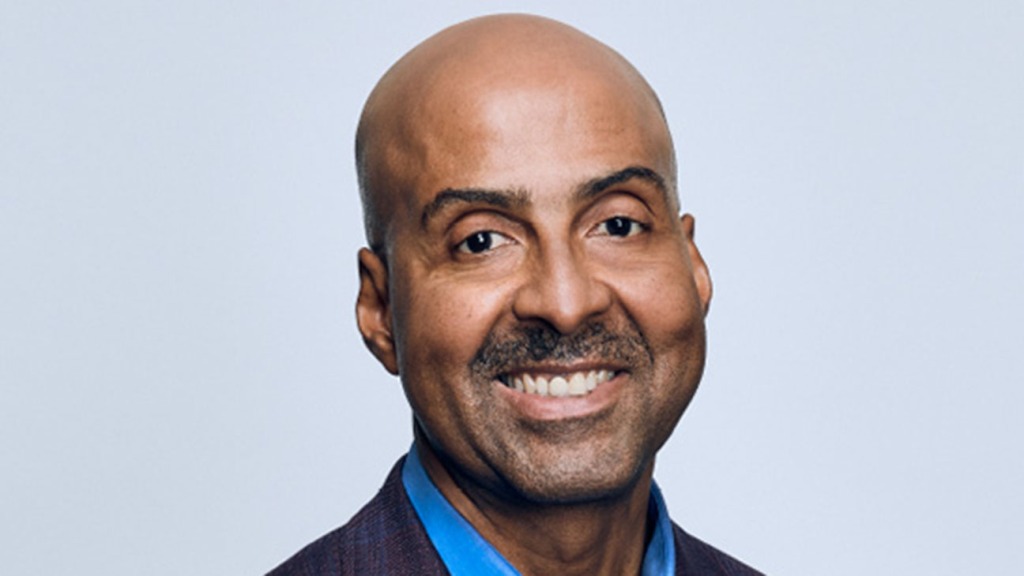

AT&T does not see cable companies’ mobile subscriber gains coming at its expense and sees a “pretty high” bar for a merger of DirecTV and Dish Network, CFO Pascal Desroches told an investor conference on Tuesday.

Speaking at the Bank of America C-Suite Technology, Media and Telecommunications Conference in London in a session that was webcast, he also compared recent chatter that Amazon was looking at offering low-cost wireless services to its Prime members in partnership with a telecom firm to Seinfeld.

AT&T, Verizon and T-Mobile, the three providers of nationwide U.S. networks, all said in statements in early June that they were not in talks for providing wireless at wholesale prices for such an offering, Desroches highlighted. Dish was also rumored to have been asked about such a service. Amazon later said it was not planning such a service at this time.

“Why would Amazon do this?” Desroches asked. “Amazon has high penetration, let’s say more than 80 percent of U.S. households. Would they really enter into a variable pricing construct for an incremental 10 percent. Also (how about) a player that is unproven and doesn’t have a built-out network at this stage? I’m just not sure that any of the players have the incentives to really lean into this at this stage.”

The AT&T CFO’s takeaway: “It’s sort of like those of you who watch Seinfeld. It’s a show about nothing. This was a rumor about nothing.”

Since AT&T in 2021 sold a 30 percent economic stake in DirecTV and its other video services, U-Verse and AT&T TV, to private equity firm TPG Capital, creating the new DirecTV, Wall Street has repeatedly discussed if a long-suggested Dish-DirecTV merger could be on the cards. The argument behind the much-discussed possible merger of Dish and DirecTV is that would help them better compete against cable companies and others in the streaming space.

Asked about that scenario and whether DirecTV could become a Dish buyer, the AT&T exec replied: “We separated from our satellite platform, and we have it in a construct where it’s been optimized by our partners at TPG. They do a really good job in optimizing that asset.”

Desroches added that AT&T has a good handle on upcoming equity cash flows from the DirecTV asset under TPG’s stewardship. “Before they would decide to do something with another party, whether it be Dish or somebody else, I think there is a fairly well-defined bar that we have,” the exec said. “Last year, it produced $4.5 billion for us. This year, we got it at around $3.5 billion. We have really good line of sight over the next several years as to what cash flows will come out of that business. And whatever we would do would have to be incrementally much better than that.” (AT&T uses the standalone DirecTV entity to help pay down debt.)

Concluded the AT&T exec: “So right now, we are in a really good position with the asset. Would we look at other opportunities? We always do, that’s our job. But the bar would be pretty high in order to do something to try to accelerate more value creation.”

How big an existential threat to AT&T is the cable industry offering wireless services? “Their share gains are not coming at our expense,” the ATT CFO said about AT&T, but suggested at least one big unnamed competitor was likely to be affected.

Desroches said though that Dallas-based AT&T sees phone subscriber additions for the current second quarter in the 300,000 range, below the 476,000 estimate by Wall Street analysts.

Desroches on Tuesday also touted record wireless industry revenue and profits, arguing the telecom sector was set up well and “incredibly healthy.”

He also emphasized that the company is following a strategy and focus that sounded similar to what streaming services operated by entertainment giants have been highlighting: “Let’s not chase subscribers for the sake of chasing subscribers.”

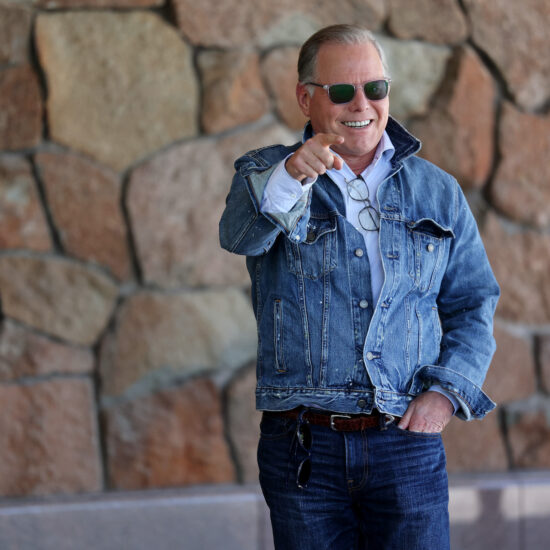

The conglomerate last year closed its sale of WarnerMedia, allowing Discovery to create entertainment powerhouse Warner Bros. Discovery.