After Walt Disney Co. completed its landmark acquisition of ABC in 1996, the entertainment conglomerate did not waste any time integrating the TV network into its corporate culture.

Every top ABC executive was required to spend the day at a Disney theme park dressed as Goofy, Pluto and other characters in the company’s universe. It was a way to get them to march in formation, as promoting the Disney brand became part of their jobs.

Having a TV network that reached nearly every household in the country helped the company launch hit movies, park attractions and Broadway shows. An episode set in Disneyland or Disney World was a given for every family-centered ABC sitcom, from “Roseanne” to “black-ish.”

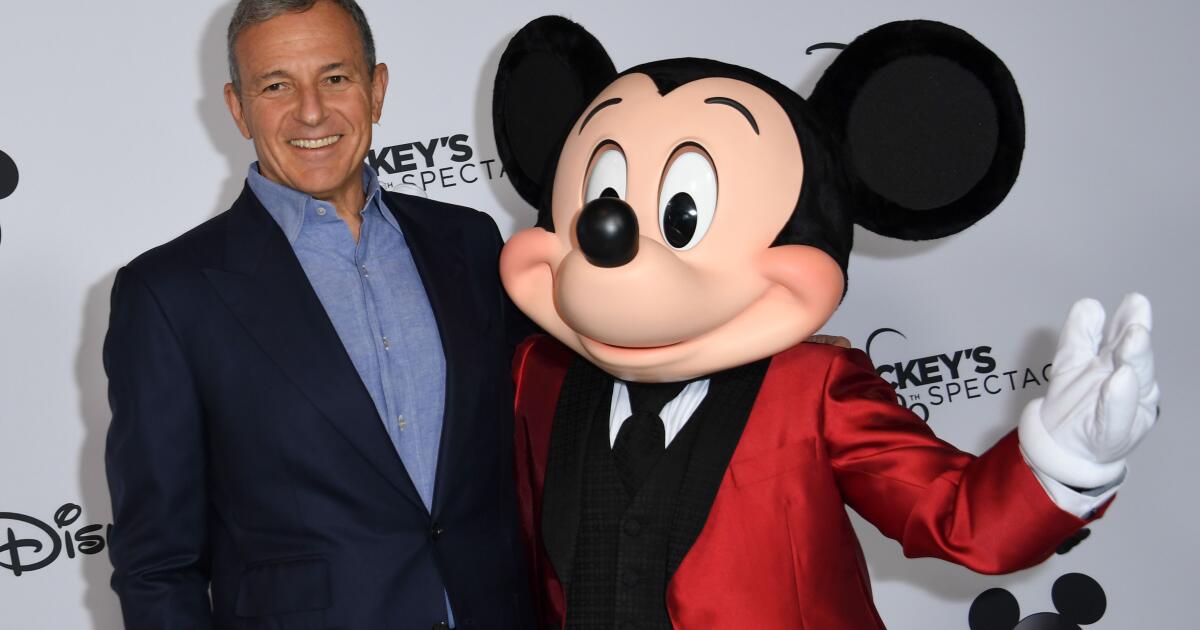

ABC has long been part of the entertainment behemoth’s DNA, which is why it came as a shock when Disney Chief Executive Bob Iger said earlier this summer that he is open to spinning off the network and its eight TV stations based in such major markets as Los Angeles, New York, San Francisco and Chicago.

Iger’s comments have already generated interest from potential suitors, including Nexstar Media Group, the largest TV station owner in the country. Byron Allen’s Allen Media Group said it would offer $10 billion for the network and stations along with several of Disney’s entertainment cable channels.

Disney tamped down expectations that any deal is imminent, saying it has not made any decision to part with the assets. But just raising the potential of a deal shows how media companies that are struggling to adapt to changes in technology and consumer behavior are forced to ponder moves once considered inconceivable.

A landmark deal

To be sure, the opportunity to acquire an asset such as a major broadcast network does not come around often. ABC has only changed hands three times since it was spun off from NBC as a radio network in 1943. It was merged in 1953 with United Paramount Theaters, a chain led by Leonard Goldenson, who guided the company into the television age.

In 1985, ABC was acquired by Capital Cities Communication, a low-key owner of TV and radio stations and print publications based in Albany, N.Y., hardly an entertainment industry hub, for $3.5 billion.

Capital Cities turned out to be a transitional owner. In the early 1990s, a change in FCC rules lifted a prohibition on networks owning their prime-time shows, which opened the doors to mergers with movie and TV studios.

Enticed by ABC’s 80% stake in sports media giant ESPN, Disney stepped up, paying $19 billion.

In the ensuing years, Disney grew and diversified, but the TV business matured. Consumers under the age of 50 have largely abandoned traditional TV for streaming video platforms when they want to watch scripted shows and movies.

“This is a smart company that has unique and compelling assets that customers care about, but it is being buffeted by the same kind of disruptive trends that we’ve seen in a lot of industries now,” said David Rogers, author of “The Digital Transformation Roadmap” and an instructor at Columbia Business School. “How do you thread this needle and transition from one set of business models to another?”

In July, Nielsen data showed that the total share of viewers watching broadcast and cable networks dropped below 50% for the first time. Streaming accounted for nearly 39%, up from 28% in July 2021. Broadcast TV’s share fell from 24% to 20% over that time, while cable’s share was 29.6%, down from 38%.

“These are not distressed assets, these are distressed business models,” Rogers said. “The business is shrinking.”

The shift has accelerated at a time when the company’s balance sheet is stretched.

Disney piled on debt four years ago to buy much of Rupert Murdoch’s entertainment assets, including the Fox movie and television studios and cable channels FX and National Geographic.

In the early days of the pandemic in 2020, after theme parks and movie theaters closed, the company took on more debt. It also suspended its stock dividend to investors. (Iger has said that he wants to reinstate the dividend by year’s end.)

The company is facing a series of notes coming due, including $1.4 billion that is maturing this year, according to Moody’s Investors Service.

Disney’s debt, minus cash and cash equivalents, is $36.7 billion, according to regulatory filings.

Moody’s gave Disney a strong A2 credit rating. The company generated $1.5 billion in free cash flow during the last fiscal quarter, and the ratings agency noted Disney has made progress whittling down its debt.

The coming months could be crucial to the company’s financial picture. Four years ago, Disney agreed to pay Comcast Corp. at least $9 billion for the Philadelphia cable company’s 33% stake in streaming service Hulu. (Disney owns 67% after the Fox purchase).

The two companies, at that time, established a floor for Hulu’s valuation at about $27.5 billion, but Comcast Chief Executive Brian Roberts insists the streaming service is worth considerably more. Analysts have speculated that appraisals could put the value at $40 billion or more.

This means that Disney might need to come up with more than $10 billion to pay Comcast to acquire 100% of Hulu.

Such demands are putting pressure on Iger, who on the surface seems like an unlikely agent for an ABC sale, which analysts say could fetch as much as $8 billion.

Iger started his career as a studio supervisor for the network in 1974, working his way up to chief executive of what was then Capital Cities/ABC in 1994.

After Disney took over, Iger’s leadership bridged the disparate cultures of the merged companies and he eventually succeeded the mercurial Michael Eisner as chief executive.

But in recent years, he has been a harsh realist about the future of the traditional TV as it struggles to survive as streaming thrives.

“Linear television — cable and satellite — is marching in a constant direction toward a great precipice and it is going to be pushed off,” Iger said a year ago at the Code industry conference in Beverly Hills — two months before his surprise return as Disney’s CEO.

The steady loss of pay TV customers cutting the cord — about 7% a year — also threatens the retransmission fees ABC receives from cable and satellite companies that carry its stations. The network has been relying on fee increases to keep the pay-TV revenue growing, but the decline in customers will eventually cut into that pie.

“He knows the legacy linear TV business is over,” said one former network executive familiar with Iger’s thinking regarding an ABC spinoff. “He wants to do it.”

The shift to streaming

It’s not just convenience that has drawn consumers to streaming.

Big money and creative freedom offered by streaming companies has lured away name brand producers away such as Shonda Rhimes. She tuned out such hits as “Grey’s Anatomy” and “Scandal” for ABC before leaving in 2017 for an exclusive deal with Netflix.

BEVERLY HILLS, CA – FEBRUARY 24: Shonda Rhimes attends the 2019 Vanity Fair Oscar Party hosted by Radhika Jones at Wallis Annenberg Center for the Performing Arts on February 24, 2019 in Beverly Hills, California. (Dia Dipasupil/Getty Images/TNS) ** OUTS – ELSENT, FPG, TCN – OUTS **

(Dia Dipasupil/TNS)

Disney has participated in the industry-wide shift of financial resources into streaming as well, as it tries to rapidly build up the programming offerings of its subscriber-based streaming service Disney+.

The company reportedly spent $15 million per episode to make the “Star Wars”-based series “The Mandalorian,” a budget that would be unheard of for an ABC show, even during the network’s glory days.

Din Djarin (Pedro Pascal) holding Grogu (aka Baby Yoda) in “The Mandalorian.” (Lucasfilm Ltd./Disney/TNS)

(Lucasfilm Ltd.)

Disney executives have also said the future of ESPN is as a direct-to-consumer streaming channel once the universe of pay-TV subscribers falls below a certain point. The company has tapped former top executives Tom Staggs and Kevin Mayer as consultants to look into strategic partners that can help in the process.

So why would another company want ABC if the future is bleak?

Unlike Disney’s direct-to-consumer business — which posted a $500 million loss in the third quarter — the traditional TV business is still profitable.

Steven Cahall, an analyst Wells Fargo, projects the combination of ABC network and stations will take in $5 billion in advertising sales and revenues from pay TV carriage fees in the 2024-25 fiscal year. That’s down from $8.3 billion reported for 2018-19.

But TV stations have high profit margins — Cahall puts ABC’s at 30-35% — thanks to political ad spending in presidential and mid-term election years. The audience for traditional TV is older, but more likely to vote, and stations located in states with contested races are flooded with candidate spots.

In 2024, spending on political ads is expected to hit $10.2 billion, up from $9 billion in the 2020 presidential cycle, with about half going to local TV stations, according to AdImpact, a firm that tracks election spending data.

On the network side, ABC has the durable reality franchise “The Bachelor” Emmy-winning sitcom “Abbott Elementary” and the annual Oscar telecast through 2028. While it ranks fourth in overall viewers among the four major broadcast networks, it had the most-watched non-sports programs among 18- to 49-year-olds in the 2022-23 season.

But its strongest assets are major sporting events such as college football, the NBA Finals and the NFL, including two Super Bowls over the next 10 years.

Those rights deals are shared with ESPN, so any new ABC owner will have to negotiate to keep those high-rated events as part of a sale, analysts have noted.

An ABC sale would not immediately provide Disney with a financial windfall. Any deal would have to be approved by the FCC and face other regulatory scrutiny.

The earliest that ABC might change hands would be late 2024 or 2025, according to one knowledgeable industry insider who was not authorized to speak publicly.

The company will likely face blowback from Washington lawmakers over what would happen to ABC News in the event of a sale. Politicians, who like to be seen on TV by constituents back home, are expected to express concern that the division remains viable.

Michael Strahan, Robin Roberts and George Stephanopoulos on the set of ABC’s “Good Morning America.”

(Lou Rocco/ABC )

The division is filled with high-paid stars such as “Good Morning America” co-hosts Robin Roberts and George Stephanopoulos. A new owner — especially if it were the highly cost-conscious Nexstar or a private equity group — will want to bring those salaries down.

ABC News employees are said to be in a panic over the prospects of a new budget-slashing owner, according to a former executive for the division, especially after seeing the cutbacks at CNN that occurred after Warner Bros. Discovery took over the channel.