The intrigue surrounding the mysterious merger plans for Warner Bros. Discovery’s major streaming services, HBO Max and Discovery+, has certainly made the dog days of summer more lively for industry pundits, trade publications like ours, and the entertainment business at large.

After WBD confirmed its plans to combine the services in April, speculation about how that would happen reached fever pitch in the weeks leading up to Thursday’s (August 4) Q2 earnings report and accompanying investors call. Some rumors prophesied the quick and nasty gutting of HBO Max’s team, with the microscope particularly trained on the streamer’s unscripted department, given that unscripted is Discovery+’s focus. For a while, it was the most buzzed-about topic in the trades.

And then Batgirl happened.

The decision to shelve a nearly completed movie that had already racked up a $90 million bill — a movie catering to an extremely loyal and vocal fanbase, no less — managed to take the industry’s eyes off of the HBO Max/Discovery+ merger ball for a few moments. But even in the days leading up to yesterday’s news, according to most of the quoted (albeit unnamed) sources, the prognosis was very grim for HBO Max.

As we see now, the truth is a little different. While there is much that is still murky, the elements of strategy that were laid out during the earnings call with WBD topper David Zaslav and streaming chief J.B. Perrette provided some clarity as to the timeline for the launch of the combined streamer, as well as other aspects of the game plan. While much remains unanswered, with more details promised for the investors call at the end of the year, here are some of the key takeaways from yesterday’s events that are of particular relevance to the unscripted content business.

The death of HBO Max was greatly exaggerated…

Judging by some of the press speculation leading up to the Q2 report, one would be forgiven for thinking that the plug was this close to being pulled on HBO Max, à la CNN+. But news that broke earlier yesterday regarding plans to move content from Magnolia Network — the JV between lifestyle moguls Chip and Joanna Gaines and Discovery that is now under the oversight of HBO/HBO Max content chief Casey Bloys — to HBO Max via a dedicated “spotlight page” over the next few months illustrated that such a drastic move wasn’t in the cards. The Magnolia content will still appear on Discovery+, and the latest iteration of the Fixer Upper franchise will debut across both platforms, but bringing the Gaines train to HBO Max perhaps points to more gradual efforts towards amalgamation of WBD’s streaming brands.

Still, the fact remains that what subscribers currently regard as HBO Max and Discovery+ will be a different animal once the combined service emerges. During the investors call, Perrette laid out the timeline for the as-yet-unnamed service’s launch, with the focus being on markets where HBO Max has already launched — which leaves territories such as the UK, Germany and Italy out of the picture until 2025. An American launch is slated for summer 2023, with LatAm to follow and European territories as well as Asia Pacific markets set for 2024.

“There’s much work to be done over the coming months, from retooling the tech platform to enabling proper content and metadata ingest around the world and ensuring a seamless customer migration for launch,” said Perrette. “There is lots to do, and we are determined to get it right, which will take a bit of time.”

…but what will the new service look like, and who will be there?

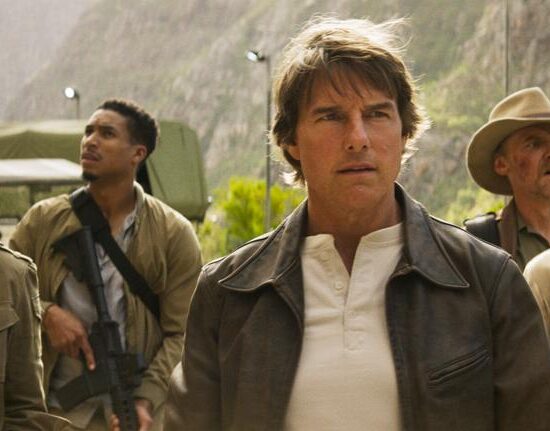

Perrette (pictured above) also added that WBD expects “peak EBITDA losses for the DTC segment will occur this year in 2022 as we do the heavy lifting around technology, personnel and integration ahead of the planned re-launch starting next summer.”

This is where some of the murkiness most relevant to the production community remains, particularly in the personnel area. When discussing WBD’s “unmatched depth and breadth of content, [which] provides us the opportunity to offer something for everyone,” Perrette highlighted the “unique and complementary” elements of both streamers, with a clear delineation between HBO Max’s scripted offerings and Discovery+’s focus on “real-life entertainment.” When it came to highlighting the “leading unscripted programming” on offer from WBD, it was Discovery+ content — 90 Day Fiancé and Fixer Upper — that got the shout-outs from the top brass.

Given this, could the content-sharing strategy seen in the Magnolia Network/HBO Max news revealed on Thursday — as well as the parallel shuttling of select CNN Originals over to Discovery+ that was also announced yesterday — be extended such that HBO Max unscripted originals and docs make their way to Discovery+ in the months ahead, in order to familiarize Discovery+ viewers with HBO Max’s eclectic non-fiction offerings? And, amid reports of “pauses” in buying and uncertainty in development affecting both streamers, when will the foot come off the brake, and who will be driving the development and buying efforts?

“The majority of the people on Casey [Bloys]‘s team have been locked up,” Zaslav said, in relation to what he called “the incredible success” that HBO and HBO Max are currently having. “Casey is here for the next five years, and we hope longer.”

Linear still matters

While the bulk of attention has been directed to WBD’s streaming and theatrical models, there has also been plenty of movement on the linear front for the company, with significant executive departures from WBD’s network portfolio prompting similar questions about what unscripted will look like across the WBD cable roster. During the earnings call, Zaslav maintained that getting the content balance right across the linear nets is as much of a priority as ever.

“We think it’s very hard to predict, but we expect it’s going to be a very significant cash generator for us and a very good business for us for many, many years to come,” Zaslav said of WBD’s linear offering, adding that, given the size and breadth of the libraries under the WBD umbrella, the content-sharing strategy will be explored for cable and premium pay TV as well.

“We haven’t begun to implement the libraries that we have now, where we could take content [like] old documentaries on crime from HBO and put them on ID, or take programming that exists in the library and move them on each of the cable channels or vice versa,” stated Zaslav.