In the end, was Spotify’s acquisition of Gimlet and Parcast all a waste?

That’s how unionized staffers at Gimlet and Parcast described Spotify’s decision on Monday to begin shuttering the two podcast studios that the audio giant had purchased in 2019 for 221 million euros. “When Spotify purchased Gimlet and Parcast for nearly $300 million, they acquired an incredible group of talented people with specific and marketable skills. Then, they wasted that opportunity: canceling shows with dedicated audiences, leaving half-finished projects to die on the vine, and giving teams little direction as to what they actually wanted to see produced,” the Gimlet and Parcast unions said. “Gimlet and Parcast were studios with vision that helped shape our industry. Whether Spotify Studios has a vision remains to be seen.”

Four years after their acquisitions, Gimlet and Parcast will sunset this summer as they combine to make Spotify Studios, an in-house studio division led by Julie McNamara. Parcast’s managing director, Liliana Kim, will stay on to oversee what Spotify describes as “current content,” which includes podcasts like The Journal and Science Vs, while Gimlet’s managing director Nicole Beemsterboer is set to depart. Liz Gateley — who previously led originals for Spotify, transitioned to a consulting role in 2020, then returned full-time again a few months ago — will again lead the development of originals like Spotify’s DC Comics podcasts.

In other words, Monday was the latest round of layoffs and organizational reshuffling to hit Spotify’s podcast business, which already underwent major changes in May 2022 and again this past January. Though Spotify Studios will continue to produce shows previously under the Gimlet and Parcast banner and greenlight new projects, the effective end of the Gimlet and Parcast studio brands serve as a bitter end to one era of podcasting, when streamers like Spotify led a frenzied wave of acquisitions that saw smaller podcast studios get scooped up for large sums of money in exchange as part of a company’s podcast business expansion and growth potential.

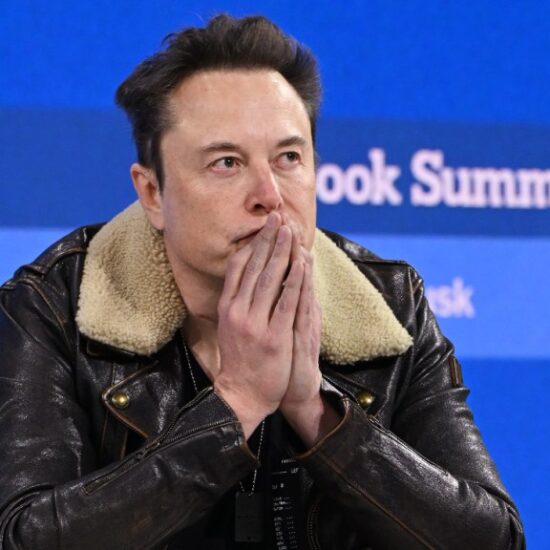

But, when the revenue side didn’t pan out as hoped, the Spotify division also became a Wall Street target for cuts. Following the layoffs and restructuring unveiled by the audio giant, Guggenheim Securities analyst Michael Morris called the move a “step toward right-sizing podcast costs and related operating expenses amid a period of slower revenue growth,” noting the unit was “ancillary” to the “core” music division and cuts will help the podcast unit reach quarterly gross profit break even by the end of 2024, he forecasts.

Not all podcast M&A activity from the 2019s and 2020s has ended in failure, most notably for studios like Wondery, which got acquired by Amazon in 2020 in a $300 million deal, and Pineapple Street Studios, which got picked up by Audacy in 2019 for a reported $18 million. (Cadence13, which Audacy purchased in 2019 in a $50 million deal, remains with the company after sale talks fell through.)

But even disregarding the fate of Gimlet and Parcast, the money and interest might not even be there for a large company like Spotify to make multimillion-dollar acquisition deals for podcast studios this time around, leaving the future up in the air for narrative podcasting shops like Luminary and QCODE that once seemed like prime acquisition targets.

Larger companies like the music livestreamer LiveOne signaled its intent in May to acquire the podcast studio Kast Media (The Sarah Silverman Podcast, Logan Paul’s Impaulsive, The OC rewatch podcast with Rachel Bilson and Melinda Clarke). But the potential all-stock deal, which has not gone through, would only be for certain Kast Media assets and would be timed to bolster LiveOne’s subsidiary PodcastOne, which is expected to be spun off into a separate public company later this year.

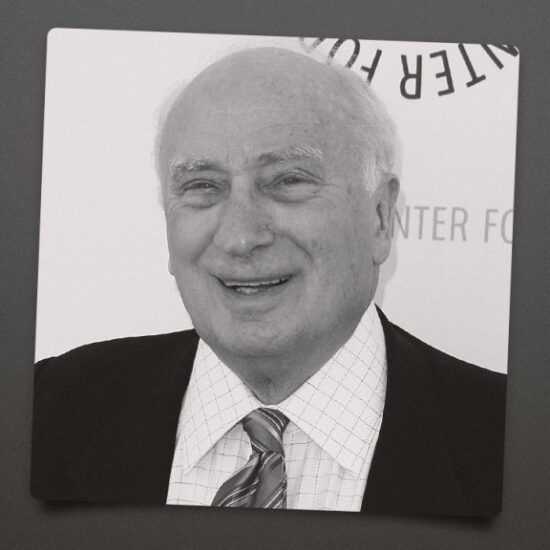

But when it comes to major acquisition deals for smaller studios focused on narrative or investigative series, such as Gimlet, “I don’t know if those deals can happen ever again,” John Perotti, the co-founder and chief content officer of Rococo Punch, tells The Hollywood Reporter. “In my experience, it doesn’t seem like anybody’s chomping at the bit to make another kind of offer like that.”

The tough podcast market and pullback in spending helped spur Rococo Punch, which Perotti leads with his co-founder Jessica Alpert, to pursue a merger with Audily, a full-service podcast and audiobook company led by president Matt Wells.

“When we were looking at the landscape in the beginning of this year, we were saying, well, we’re having a really hard time producing narrative stuff and just the all the stuff that we made in the way that we normally did, right? Nobody wanted short-run series anymore. It was very difficult to even get always-on stuff through. Everybody had frozen their spending,” Perotti recalls. “When we were kind of sitting there, we were just like, what can we do? How do we pivot? How do we how do we fix this?”

The deal will keep Rococo Punch, which has produced shows like Welcome to Provincetown but also creates educational and work-for-hire projects, as an independent entity within Audily. And perhaps most unlike the Spotify–Gimlet–Parcast deals, Perotti doesn’t see much overlap between Rococo Punch and Audily.

“We are a larger company, but we’re not a large company that’s doing all the same stuff. We’re not stepping on each other’s toes. We’re not making the same content, necessarily, but I think we can help their clients and they can help our clients,” Perotti says. “We’re looking for different things.”

Will this solution still prove sustainable in a year or two? Perotti doesn’t have a crystal ball, but he sees the merger with Audily as the right step forward in allowing Rococo to remain independent and still running.

“I’m hoping that there’s a lot of small companies out there that might think about doing what we’re doing, because it feels … like weatherproofing your company for whatever is about to come,” Perotti says. “We made a smart choice and we’re waiting and watching to see what happens in the industry.”