After teeing up Wall Street for a difficult fiscal second quarter, the tech giant Apple beat analyst expectations for the quarter, delivering revenue of $94.8 billion (expectations were for $92.9 billion), down 3 percent year over year, and earnings per share of $1.52, flat compared to last year (expectations were for an EPS of $1.43).

Apple’s services segment, which includes Apple TV+, Apple Music, Apple Arcade and other offerings, continues to grow at a rapid clip, reporting revenue of $20.9 billion, a new record.

The company reported net income of $24.16 billion, down from $25 billion a year ago.

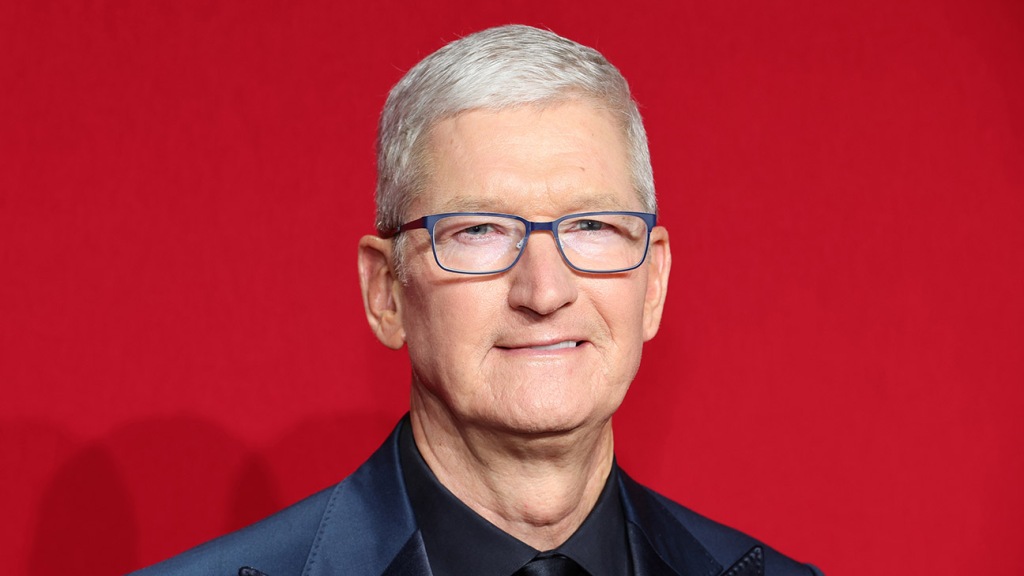

“We are pleased to report an all-time record in Services and a March quarter record for iPhone despite the challenging macroeconomic environment, and to have our installed base of active devices reach an all-time high,” said Tim Cook, Apple’s CEO. “We continue to invest for the long term and lead with our values, including making major progress toward building carbon neutral products and supply chains by 2030.”

Apple also increased its dividend, and announced an additional $90 billion in share repurchases.