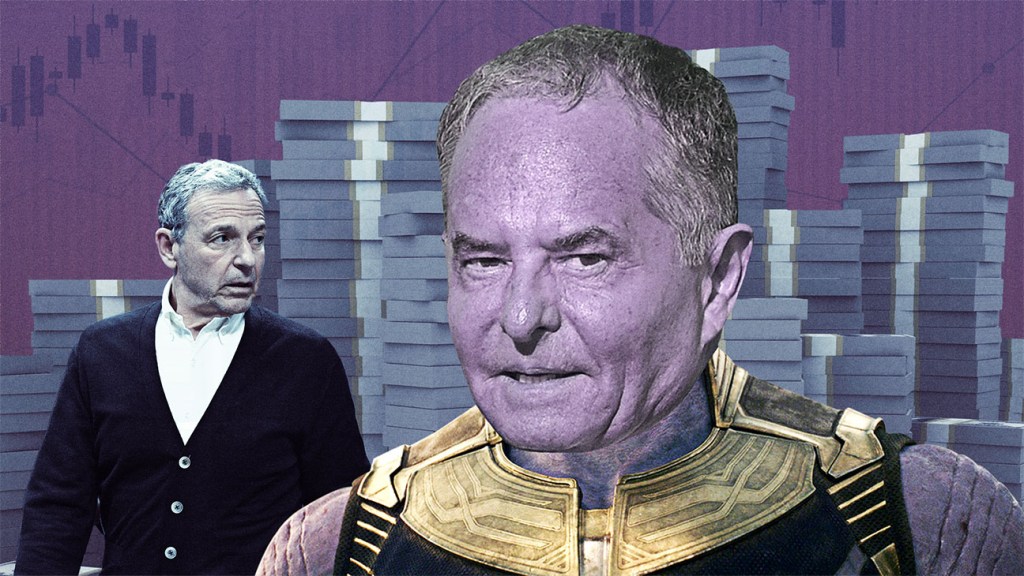

The last time Nelson Peltz and his firm Trian Partners waged a proxy battle against Disney, less than a year ago, they laid out their concerns in a PowerPoint presentation. Disney needed to cut costs, Trian said. It needed to bring back its dividend and get its free cash flow back on track. Disney was “over-earning” at its theme parks, gouging guests and not investing enough.

Bob Iger’s return as CEO in November 2022 and the stock surge that followed ultimately called Peltz off. “This was a great win for all the shareholders. Management at Disney now plans to do everything that we wanted them to do,” Peltz told CNBC in February, announcing that he was dropping his proxy fight.

Indeed, Disney did tackle essentially all of Peltz’s concerns. The company has cut $7.5 billion in costs and laid off thousands of employees. It is bringing back its dividend, and says free cash flow will hit pre-COVID levels this fiscal year. The company announced a $60 billion investment in its theme parks business, suggesting that it wants to grow it by adding more, not by charging more.

And yet, months later, Peltz is back. And while he was looking for only one board seat last time, now he is looking for at least three, and possibly more, sources tell The Hollywood Reporter.

The question on the mind of Iger and other Disney execs — not to mention much of Wall Street — is what Trian’s case will be. Exactly what argument Trian, whose stake in Disney is valued at roughly $3 billion, intends to make (beyond the activist track record of the 81-year-old Peltz) is unclear. Yes, Disney’s share price continues to lag, though it is hardly alone among media companies this year.

“I’m certain that the board will hear them out in terms of what their plans are, what their ideas are,” Iger said at the Dealbook Summit on Nov. 29, adding that he made it “very clear” to Disney’s board that “we have to obviously contend with them in some form, but don’t force me to take my eye off the ball and lose focus in terms of managing the company.”

Trian said in a statement that it was offered a chance to meet with the board, but that it was not proactively offered any seats, forcing it to take its case to shareholders. One of those Disney shareholders, investment firm Ancora Holdings Group, backed Trian Dec. 5, saying Peltz “would make a fantastic addition to Disney’s board.”

Iger said the company has high standards for its board members, which will number 12 at the next annual meeting, and that the board takes the process of adding members seriously, and doesn’t just offer them to any askers. Disney, for its part, named Morgan Stanley CEO James Gorman and former Sky CEO Jeremy Darroch to its board in November. Both will be up for election at the company’s next annual meeting.

Disney has long been willing to deal with activists. In fact, it is dealing with another one now: ValueAct. While the San Francisco-based investment firm has a reputation for being active, sources say its stake is based on what it sees as the intrinsic value of Disney’s theme parks, rather than a desire to shake things up. It is not expected to seek a board seat.

And the company dealt with Dan Loeb’s Third Point in 2020 and 2022. Sources noted that both times Loeb laid out “detailed” strategic plans, something Trian has thus far not done. In 2022, Disney added former Meta executive Carolyn Everson to its board at Third Point’s urging.

Another activist investor and Disney shareholder, Blackwells Capital, believes that defending against Peltz’s proxy fight will cost Disney shareholders “upwards of $50 million and serve only as a value-destructive fog for Disney’s leadership and board.”

“Mindless, drum-beating activism is not the right strategy for shareholders,” Blackwells chief investment officer Jason Aintabi says. “Disney’s Board is acting in the best interests of all shareholders and should be allowed the time to focus on driving value at one of America’s most iconic companies without this fatuous sideshow.

But Peltz’s effort does have its share of supporters. Bill Ackman, the influential hedge fund manager and founder of Pershing Square Capital Management, was seen at the Dealbook Summit carefully listening to Iger, Elon Musk and other interviewees. Iger’s remarks about Disney pulling its ads from Musk’s X (Twitter) seemed particularly troubling to Ackman, who has expressed disapproval of “Disney [caving] to public pressure” regarding X while investing heavily in TikTok.

“If Bob Iger would carefully examine the facts, he would likely continue to advertise on X, but Disney caves to public pressure rather than do the right thing,” Ackman wrote on X. “Meanwhile Disney invests heavily on TikTok, likely alongside videos of kids teaching other teenagers to be anorexic and worse. I am sure Nelson Peltz can fix this when he joins the Disney board.”

Looming over it all is Isaac “Ike” Perlmutter. Peltz’s friend and neighbor in Palm Beach, Perlmutter was “terminated” as chairman of Marvel by Disney this year, the company notes. Perlmutter has pledged his shares in Disney to Peltz, and they comprise nearly 80 percent of Trian’s stake, giving him more financial skin in the game than Peltz. On Nov. 30, Disney cited Perlmutter’s “personal agenda” against Iger, noting that his interests “may be different than that of all other shareholders.”

While a source close to Perlmutter previously told THR that the former Marvel chief was “not involved” in Peltz’s new effort beyond pledging his shares, an SEC filing from Trian confirms that Perlmutter is a “participant in the proxy solicitation.” In Trian’s last proxy fight, it only alluded to Perlmutter’s role (it referred to him as a “third party” known to both Disney and Peltz). Disney made some adjustments to its bylaws in November, which, while largely technical, could shine a light on just how involved Perlmutter is in Peltz’s board play, with enhanced disclosure requirements.

During his 14-year run at Disney, Perlmutter’s influence waned as the years went on, and by the time he was let go, his oversight was restricted largely to consumer products. The reclusive mogul, rarely photographed, was pictured with Donald Trump at the former president’s Florida retreat in 2016. In his 2019 memoir, Iger wrote that Perlmutter was opposed to Marvel projects like Black Panther and Captain Marvel (he allegedly didn’t think a Black or female superhero movie would sell toys), and later said that Perlmutter wanted to fire Marvel Studios chief Kevin Feige, forcing Iger to step in and move Marvel Studios under the larger theatrical umbrella.

It’s that meddling while leading Marvel that has some worried, should Trian’s endeavor succeed. “There is no silent partner in Ike,” one source warned of Perlmutter. “You’re inviting Trump onto the board. He has proxied his vote to Nelson. It’s so dangerous.”

Kim Masters contributed to this report.

This story first appeared in the Dec. 7 issue of The Hollywood Reporter magazine. Click here to subscribe.