The premium end of the streaming video sector in India is poised for shake-up, with Reliance Industries’ JioCinema challenging the SVOD dominance of Disney+ Hotstar, new research suggests.

“The India Online Video Report: Analysis of Consumption, Content & Investment Trends,” from Singapore-based Media Partners Asia, shows total consumption across the online video sector reached 6.1 trillion minutes for the 15-month period from Jan 2022 to Mar 2023.

Within that period, the SVOD, AVOD and freemium platforms accounted for some 12% of viewing time, up from 10% in 2021. Social services such as YouTube and TikTok accounted for 88% of viewing time.

That positions India behind Australia, the most developed market in Asia where premium services enjoyed 35% of viewing time, but close to Japan and Korea (15% of viewing time) and ahead of emerging markets in Indonesia, Thailand and Philippines, where the norm for premium VOD share is below 10%.

Disney+ Hotstar dominated premium VOD over the 15-month period to end of March 2023, with 38% of the sector viewing time. “Its success was driven by sports as well as the depth of its Hindi and regional entertainment,” the report said.

The big shake-up that Media Partners identifies comes from the significant upgrading of the JioCinema service from April, which during the report’s 15-month span, only accounted for a 2% share of the premium video market in India.

After April, JioCinema began free-of-charge transmission of the IPL cricket tournament, which is hugely popular, and before this year was the preserve of Disney-owned media in India.

“In April 2023, in spite of several tech glitches impacting user experience, the free live streaming of the men’s IPL cricket ensured that Jio Cinema consumption grew more than 20x in April 2023 to ensure that it dominated the premium VOD category. It remains to be seen whether its platform can maintain its growth and scale in the absence of IPL action after June 2023,” the report said.

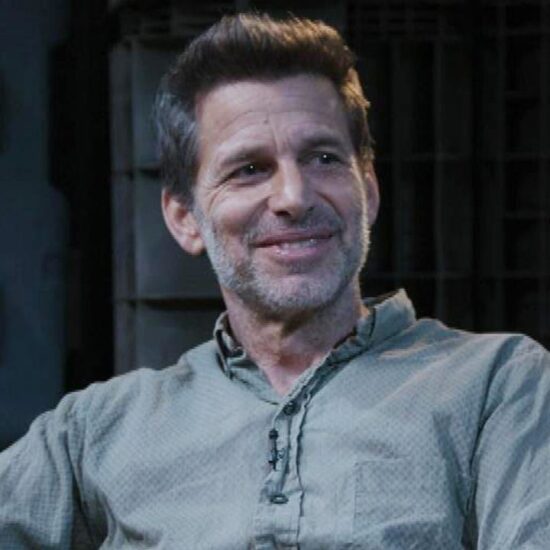

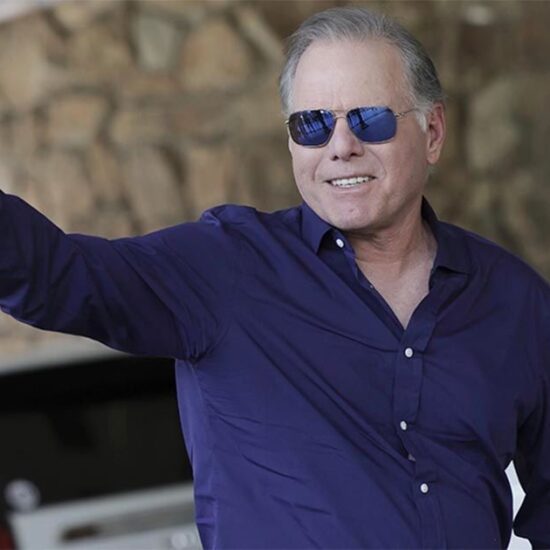

In the intervening period, JioCinema has also announced parts of a huge slate of original films and TV series, won the bidding for the Warner Bros Discovery content package that was previously with Disney’s Star TV, and announced pricing for an HBO tier.

In the 2022-23 reporting period Media Partners Asia says that Zee and Sony together have 13% of the Indian premium video sector viewing time. The two companies are expected to merge, though regulatory approval is dragging on, and the research firm says that they “are expected to operate separately for another year, benefiting from strong engagement across sports as well as regional, local and international content.”

During the measured period, Prime Video and Netflix had an aggregate 10% share of premium VOD category viewership. “Prime Video continues to benefit from a good mix of content across genres and languages with crime & thriller and action & adventure leading the way. Prime Video also garnered almost a third of its viewership from regional Indian titles. In aggregate, more than 60% of Prime Video’s viewership was anchored to local content,” the report said.

“Local content’s contribution to viewership at Netflix was 24%. Netflix’s Indian originals have not been able to sustain their buzz for a long period of time. In contrast, various seasons of Netflix’s major US titles have achieved sustained viewership,” the report said.

Local content dominates premium VOD viewership outside of the sports category, but paid tiers are led by international content, the report says.

Catch-up TV content dominates the free-tier across freemium streaming platforms. Indian content dominates premium VOD viewership, excluding-sports. International content contributed 51% of total paid tier premium VOD consumption over 2022-23.

U.S. content remains the primary driver with 36% share while Korean content is growing and reached 6% share during the measured period. Local content contributed 49% overall to the paid tier with Indian originals contributing 26%.

Warner Bros., Netflix Studios and Disney’s Marvel Entertainment are the leading studios in terms of share of U.S. content viewership. Applause, Endemol, The Viral Fever, D2R Films and Excel Entertainment were the key drivers of Indian original series viewership.