Amid cost-cutting, the flexibility of streaming and the lessons learned during the pandemic, the industry doesn’t work the way it did 15 years ago

For TV writers, the current negotiations are “in some ways a much uglier situation than almost the innocent times of 2007/2008,” former NBC Studios and UPN executive Tom Nunan told TheWrap.

The previous strike lasted for 100 days and resulted in the loss of almost 25% of primetime scripted programming for the 2007-2008 network season. That forced studios and networks to get creative and take advantage of the groups that weren’t unionized. It would become a boon for unscripted TV. The industry was much different then — streaming TV was in its infancy.

“In 2007-2008, it was sort of in the middle of a very active network viewing cycle and a very disruptive time of the year for studio people as well as writers and there were fewer outlets,” Nunan explained. “The writers had more leverage in a way because the industry hadn’t suffered a work stoppage in a very long time and it was sort of unprepared for how to stock up on shows and how to respond in a more defensive manner should there be a work stoppage. So the level of chaos was high, which worked in the writers’ favor. But setting all of that aside, the gains they made really weren’t that significant long term.”

Streaming is now at the center of these new negotiations as writers have found that the large upfront payments they’ve come to accept in streaming deals pale in comparison to the money they made with the broadcast and cable networks’ longer-running shows with more episodes per season. Not only that, but the popularity of streaming means their work could be watched by millions more people compared to linear — and repeatedly — but writers aren’t included in most backend and residual payments for streaming. And then there’s the practice of mini-rooms, where streamers hire fewer writers at minimum pay levels to churn out more scripts before production begins.

Set on not finding themselves in a similar situation as they are now with streaming, the WGA also has its eye on emerging technologies such as AI.

But timing is everything and according to the former network execs who spoke to TheWrap, the TV industry is in a very different place than it was 15 years ago when the last writers’ strike went down.

Studios are already looking for cost savings

The situation is “much, much different” as all the major media companies are tightening their belts, Nunan pointed out.

“They’re looking for ways to save and in some ways they’re looking for radical ways to save… the kind of cost-cutting that’s going on in the industry right now hasn’t occurred at least in my memory in many years, if not decades,” he added.

Warner Bros. Discovery, Disney and even tech-rich Netflix and Amazon Prime Video have been undergoing layoffs, freezing content budgets and looking for potential new revenue in advertising, third-party licensing and returning to theatrical movie releases.

“So the idea that there’s a possible labor threat to these companies that are already looking for massive savings is sort of bad timing on the writers’ part,” Nunan continued. “It’s nothing to do with them, it’s just the way of the world.”

Linear will be hardest hit

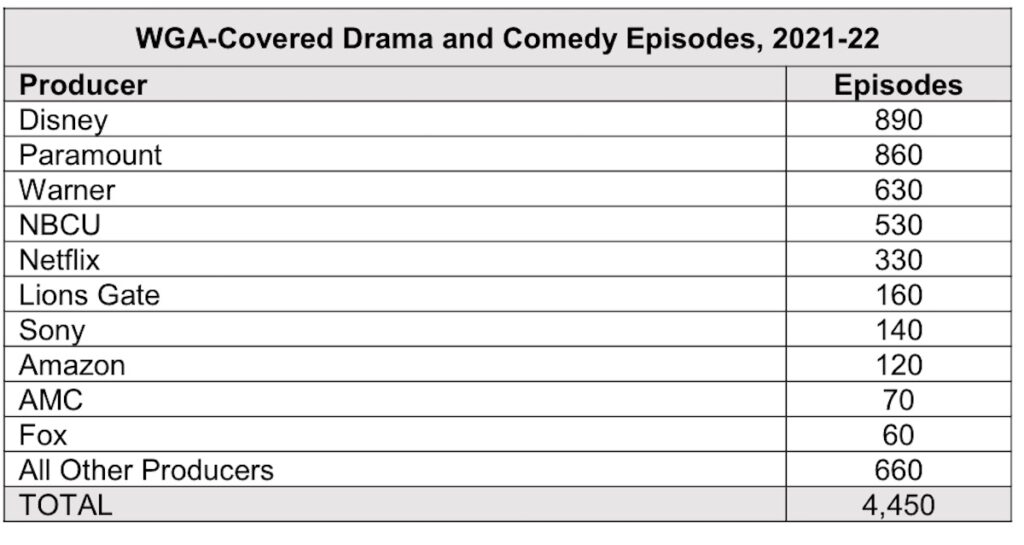

In a recent memo outlining the potential devastation created by a writers’ strike, the WGA warned that a work stoppage in May could delay the network television season, which continues to account for one-third of all episodes produced, including 45% of the episodes produced by legacy media companies Disney, Paramount Global and Comcast NBCUniversal.

The WGA memo also warned that new episodes of late-night shows including ABC’s “Jimmy Kimmel Live!,” NBC’s “The Tonight Show Starring Jimmy Fallon,” “Late Night With Seth Meyers,” “Saturday Night Live,” and HBO’s “Real Time With Bill Maher and “Last Week Tonight with John Oliver,” among others would cease immediately.

In 2007, the loss of original programming had a significant impact on ratings, with the major broadcast networks’ ratings declining, on average, by double digits compared to the same period in the previous year, according to Morgan Stanley analyst Benjamin Swineburne.

“Should a strike occur in 2023, delay or loss of original primetime programming could similarly affect ratings,” the WGA said.

But Nunan argued that the “seasonal nature of television has kind of gone away” and thus mitigates the threat of lower broadcast content and ratings on the entertainment industry.

“I just don’t think that it’s gonna be quite as dramatic a disruption as the guild is describing and I’m not sure the big networks and media companies care as much as they once did because they have streaming services and other revenue to offset any kind of disruption of the fall season,” he added.

Nunan acknowledged that a strike could potentially accelerate “the demise of some of the weaker broadcast options,” but pointed out that the decline in broadcast has “seemed to have been on the horizon line anyway.”

“Audience viewership is down so dramatically when it comes to broadcast TV,” he said. “While it’s still a major revenue source for these media companies, culturally, socially, it’s no longer the thing that really drives the conversation in terms of viewer lifestyles.”

Streamers can fall back on extensive content libraries

The WGA memo also outlined how a strike can directly affect streamers in addition to a trickle-down effect from less linear programming.

“Streaming services owned by the legacy media companies, including Hulu, Peacock and Paramount+, would also lose this programming as their content lineups prominently feature in-season network television content like ‘Abbott Elementary,’ ‘Chicago Med’ and ‘NCIS’ that is made available the day after network airing. Hulu, for instance, gets twice as many new episodes from ABC and Fox in-season broadcast content as it does from its entire lineup of scripted originals.”

It also warns that a strike would hit networks and streamers (who have become increasingly dependent on advertising revenue as well) just as upfront presentations are set to begin this month: “A work stoppage could delay sales or place pressure on advertising rates and price increases.”

And there would be additional hits to licensing revenue due to lack of content that “can amount to millions of dollars per episode” in losses.

But former ABC Daytime executive Brian Frons told TheWrap that dealing with COVID was good training for a strike if one is programming a platform or a channel.

“Access to original programming will slow to a trickle, and marketing efforts will push the massive amount of library all the platforms have made or acquired. In the short run, profit margins will expand,” Frons said. “In 2008, the focus was on the networks, which needed original programming and pushed reality as a solution — expect more of that too.”

“There’s so many other options and there’s libraries of content that still haven’t been explored on the streaming services,” Nunan also said.

Nunan argued that while churn could become an issue during a prolonged strike, streamers likely wouldn’t see the impact until the fourth quarter of 2023 or first quarter of 2024.

“The subscription part of this equation I think is more of a longer term play, not an immediate term play and I’m not even sure that that it would be a big deal issue given the robust nature of most of these streamers’ libraries and ways for them to reposition and re-market the content that’s available in those libraries,” he said. “There are programming options with subscribers that I think the Writers Guild may be underestimating.”

In an April 17 post, LightShed Partners analyst Rich Greenfield said that an extended WGA/AMPTP strike could lead to “notably better than expected streaming profitability across the streaming landscape.”

“The two stocks that would likely benefit the most are WBD and [Paramount], given investor focus on the balance sheets of both companies,” he said. “It’s worth noting that while a prolonged strike could boost earnings and free cash flow in 2023 while depressing 2024 to some degree as production ramps back up, it is possible that some content originally slated for 2024 gets pushed to 2025 to make room for delayed 2023 content — yielding minimal impact on 2024 earnings/free cash flow.”

Frons predicted that studios who will be best prepared for a strike are those with libraries to “substitute in the place of originals,” such as Warner Brothers Discovery, Disney, Paramount, NBCUniversal and Netflix, or who have revenue streams outside of their video business, like Amazon.

“Sony will sell the library, but won’t be able to make much,” Frons added. “Apple has no library really, so maybe they push for more sports to fill the gap.”

The good news is…

A writers’ strike may not even get to that points addressed above. Ultimately, Nunan believes AMPTP and the WGA could reach an agreement “swiftly.”

“I really believe that this is a solvable problem. The two biggest issues seem to be how can we create a more fair and equitable streaming/residual relationship with writers and can we eliminate these mini rooms that are really unfair to writers in the short and the long term? Those seem to be the two primary issues and I think both of these are addressable,” he said. “They may not be able to be addressed in the dramatically substantial fashion that the writers may want, but they could at least make progress on those fronts, I think, rather quickly. But it’s just gonna be a question of do the studios really want to continue working or are they looking forward to this work stoppage? And that’s a question I don’t know the answer to.”

That would be good news for not only the 11,500 writers of TV, film and streaming media represented by the WGA, but all the countless other jobs that would be impacted by the strike — not to mention the viewing experience for fans.

The AMPTP declined to comment. The Writers Guild didn’t immediately return TheWrap’s request for comment.

Want more information on the reasons behind a potential strike? Read about all the issues here.

- timewarnerent.comhttps://timewarnerent.com/author/gleberman1236/

- timewarnerent.comhttps://timewarnerent.com/author/gleberman1236/

- timewarnerent.comhttps://timewarnerent.com/author/gleberman1236/

- timewarnerent.comhttps://timewarnerent.com/author/gleberman1236/