In the four years since roaring to life, Leonine Studios has reshaped Germany’s film and television landscape, becoming a leading player in Europe’s biggest and most competitive market.

The company is receiving Variety’s International Achievement in Film Award at the Cannes Film Festival.

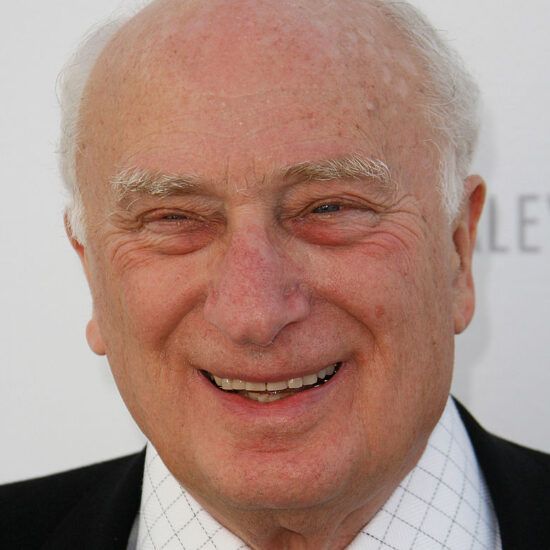

Built by industry veteran Fred Kogel with financing from U.S. private equity group KKR, Leonine Studios is an entertainment conglomerate that has brought together some of Germany’s most successful production and distribution companies under one roof.

“I always wanted to establish and create a company as a home of talents – the best people in the German business and then internationally – and create a new company for the digital age,” says Kogel, Leonine’s CEO. “That was the reality behind bringing Leonine to life in 2019 as that was the first time that German content could travel the world. That was the rationale.”

“It was always a pity for me that the programs, the productions that I did in the past almost all ended at the German, Austrian and Swiss borders because of the German-language barrier,” adds Kogel, whose long career has seen executive stints at broadcasters ZDF and Sat.1, the once mighty Kirch Media and Constantin.

“The streamers made it possible,” adds Kogel.

“Dark”

Netflix

Indeed, Netflix’s hit science fiction thriller “Dark,” produced by Quirin Berg and Max Wiedemann’s W&B Television, showed just how globally successful a German series could be. Modern audiences are increasingly open to international programs as long as they are of good quality, he stresses.

Kogel realized his vision of forming a new enterprise by acquiring W&B Television and sister company Wiedemann & Berg Film along with Herbert Kloiber’s Tele München Gruppe, RTL distribution firm Universum Film and entertainment producer I&U TV.

Wiedemann & Berg – one of the few German production companies with a proven track record in making internationally successful premium productions – was a key element. Berg and Wiedemann agreed to be part of the venture after discussing the project with Kogel.

Creating the new conglomerate from scratch was important for Kogel. A CEO of an existing company is always restricted by tight structures, he explains. Building Leonine as a greenfield project gave him the freedom to create the company he wanted.

It was like putting a puzzle together, Kogel explains, noting that he had a very strategic idea from the outset: an integrated production, distribution and licensing company that would produce domestic and international theatrical features, high-end series and scripted shows for streamers and broadcasters as well as factual productions and entertainment formats.

Kogel pitched his idea to Philipp Freise, KKR partner and co-head of European private equity, who he has known for years.

“I would very much like to see KKR as a long-term partner for Leonine because, to be very honest, for me personally, KKR is the best partner I’ve ever had, and I mean that from my heart because it’s very entrepreneurial.

“I really like the private equity situation, which happened to me very late in my life, but it brings a lot of fun. We meet the targets so KKR lets us do our thing and they are very supportive.”

Kogel is aware, however, that the relationship with KKR will not last forever.

“I know, and Philipp Freise told me right at the very beginning, ‘You know Fred, you can be sure that we will sell one day because that’s our business.’ But this is a very fair deal and I can live with that very well because we know we are working on a target and then you continue.”

Regarding a possible future sale of the group, Kogel says nothing is fixed in any way. “It could be lots of possibilities because Leonine is a very good strategic asset for anybody who wants to have a closer look at Germany. We are simply the German champion in production, distribution and licensing. That was always the goal and this is a goal we are working very hard for every day.”

Despite a rocky start, Leonine has continued to see strong growth. “It’s always important for a venture like Leonine to have good numbers and we have been working hard and achieved our goals despite headwinds from various sides, like COVID and the overall economic situation.”

Kogel notes that Leonine is expecting “a very strong 10% CAGR [compound annual growth rate] for the years 2020 to 2023 … for both total output and adjusted EBITA [earnings before interest, tax and amortization], which is supported by our well diversified product portfolio and the deep value chain.”

Leonine’s growth is also evident in its increasing number of employees. At the end of 2019, the company had a total of 550 employees. By the end of 2022, that number had reached 1,400.

“For us it was always important to grow organically. This is what we did because our basic idea is to help and integrate and go a long way with the company we acquire via M&A.”

Indeed, Leonine’s M&A strategy is to acquire 100% of targeted companies and fully integrate them. “We service the group units with finance, IT, legal and HR so that they can focus completely on the creative process.”

While Leonine is seeking to expand in Europe — and in 2021 joined French sister company, likewise a KKR asset, in acquiring a majority stake in U.K. producer Drama Republic — current market conditions make acquisitions at the moment unlikely. The situation could change in six to 12 months, however, Kogel notes, adding that companies at the moment are still priced very high.

Germany’s difficult economic situation has also taken its toll, particularly when it comes to production costs, Kogel says. The company’s travel costs alone have increased between 200 and 300%. High inflation, market insecurity and TV ad cancelations have resulted in “a high-tension situation.”

While Leonine attributes its success in part to streaming platforms, it is also pushing for a fairer regulatory framework that would help its companies and other domestic producers retain more rights to their shows.

“In the vast majority of cases, the common business practice in Germany is a total buyout, and with the streamers also a cost-plus margin concept,” Kogel states. “This is a pity because the producers should be in a role where they keep their IP and that’s of course what Leonine tries to do and is thus gathering as many IPs and great concepts as we can.

“Sometimes you can negotiate with a few streaming platforms a retention of rights but these at the moment in my opinion are not that valuable. That’s one of the reasons we have a strong focus on the introduction of an investment obligation for international streamers operating in Germany, very similar to what our colleagues in France have achieved.”

In France, the first country to approve the European Union’s Audiovisual Media Services Directive (AVMS), streamers have to invest two-thirds of their overall spend on independent productions whose rights revert to producers after three years, while leaving one-third for flat-fee production deals in which they keep all rights.

Rights retention for producers and performance-based revenue entitlements are the main aspects of the investment obligations, Kogel adds. “So on a political level, the investment obligation is a top priority for us and I think it’s essential that it’s implemented in Germany as it already exists in France to provide a regulatory framework to counter oligopoly-like structures that are currently prevailing and to create a level playing field. All rights should revert back to the production company after three years.”

Rights are another key cornerstone for the company and its Leonine Licensing division, which boasts an extensive library.

Leonine’s headquarters in Munich

Courtesy of Leonine Studios

Based in Munich and named after the heraldic lions that adorn the Bavarian coat of arms, Leonine has taken its place among the city’s other high-profile players, Constantin and Beta Film, whose own legacies may have planted the seeds of Kogel’s venture.

Kogel counts among his inspirations industry leaders who have left an indelible mark on Germany’s media industry: Beta Film founder Leo Kirch, Constantin’s Bernd Eichinger and Beta’s current owner and CEO Jan Mojto.

“When it comes to Leo Kirch, he was simply a great entrepreneur. He had a film or a production, he wanted to sell it the best he could. He was a trader. He did everything in his entrepreneurial life make the best trades. Bernd Eichinger was always like my older brother. I admired his courage and his will to do the best productions, to make product that is premium, and he was phenomenal at it. And Jan Mojto, I worked a long time with him. He was my chairman of the board at Sat.1 – that’s where we started and we went a long way. I always admired him for his internationality and his deep knowledge of the business. He for me is the perfect salesman and he also is just simply a great human being and that is reflected in his love for product and people. And combine all those, they make a good role model.”

Kogel adds: “Munich was always strong with the likes of Constantin and Beta but now it has a third major player and this is Leonine. I think it really has strengthened the state of Bavarian and the city of Munich as a media hub.”