“Do or not do. There is no try.” — Yoda (“The Empire Strikes Back,” 1980)

Disney’s prowess as an entertainment powerhouse is undisputed. Aaron LaBerge, chief technology officer of the Disney Media & Entertainment Distribution (DMED) division, argues that the company also has also built an industry-leading competency in ad tech.

Over the last several years, LaBerge’s team has created its own advertising-delivery stack from the ground up, centered on the proprietary Disney Ad Server. The company deployed the new Disney Ad Server on Hulu last year — and it’s now also powering Disney+ with ads, which launched last month. Currently, the Disney Ad Server delivers some 500 million ad impressions per day.

“What you saw with ads on Disney+ was the first product to launch on that ad server from end-to-end perspective,” says LaBerge.

Why did Disney build its own proprietary technology for digital ads? According to LaBerge, owning that piece of the chain gives the company greater flexibility and control, in order to prioritize delivery behavior for ad clients and its own business. At the same time, the Disney Ad Server is designed to be able to integrate with partner ad solutions — on Disney’s own timetable, without having to rely on a third-party vendor, as some streaming rivals do. (Netflix, for example, has teamed with Microsoft to run ads off the Xandr platform, which Microsoft acquired from AT&T.)

The development of the Disney Ad Server is “focused on our continued commitment to the advertising business,” LaBerge says.

So far, the Mouse House hasn’t disclosed how many people have taken Disney+ Basic With Ads ($7.99/month, priced 27% less than the no-ads plan at $10.99/month) since it launched Dec. 8 in the U.S., or a timeline for the international expansion of the cheaper product.

Execs will likely shed some light on the Disney+ ad-supported tier when the Mouse House reports December 2022 quarter earnings (Q1 of Disney’s 2023 fiscal year) on Feb. 8. It will be the first call with returning CEO Bob Iger — who resumed the helm after the Disney board abruptly booted Bob Chapek from the Magic Kingdom in November. Prior to that, the company this week (on Wednesday, Jan. 25) plans to provide an update on its advertising ops with the livestreamed Disney Advertising Tech & Data Showcase, leading up to its May upfronts presentation for marketers.

The core component of Disney’s Unified Ad Platform (dubbed UAP internally) is the Disney Ad Server (DAS). With DAS, Disney has direct control over core ad-decisioning mechanics, according to LaBerge. It also provides support for proprietary ad formats developed by Hulu, including Pause Ads, Binge Ads and GatewayGo (which shows viewers interactive, personalized marketing offers).

Because Disney owns and controls DAS, the company can use first-party data without any privacy concerns about sharing that info with an external company. Disney’s Audience Graph of first-party data, which has been in development for more than a decade, gives advertisers access to more than 1,800 segments with visibility into 100,000 audience attributes, per LaBerge.

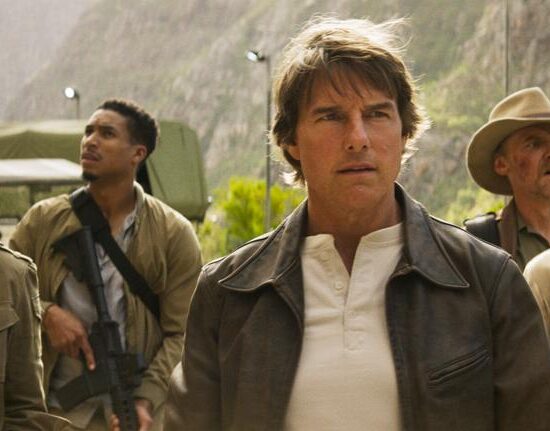

Aaron LaBerge, CTO of Disney Media & Entertainment Distribution

Disney’s Unified Ad Platform also comprises something cutely called YODA — which stands for Yield Optimized Delivery Allocation. YODA is an algorithmic engine that determines when to serve an ad to an individual viewer. Later this year, according to LaBerge, YODA will enable automated competition between direct-sold and programmatic ad buys; that, the theory goes, will let Disney boost yield optimization with higher CPMs (cost per thousand impressions) at scale. That feature will tap into the Disney Realtime Ad Exchange (DRAX), the media conglomerate’s in-house supply-side platform (SSP) that hosts internal auctions across all programmatic endpoints to select the highest value ad while supporting key partner deals.

“We’re filling up the entire curve with appropriate demand,” says LaBerge, who before assuming his current role as DMED’s CTO in 2018 was chief technology officer of ESPN.

In addition, the UAP provides a self-service component, designed to lower the barrier of entry for small to midsize agencies to purchase Disney’s premium ad inventory by letting them build and manage campaigns themselves. Disney says it will open it up to an even broader number of agencies in 2023.

“Building a dynamic ad platform that includes measurement is incredibly complicated,” LaBerge says, adding: “This is a ‘forever’ investment for Disney.”