Atlanta-based Fin-tech company FilmHedge has closed on $100M in debt financing to modernize Film and TV financing with its tech and data products.

The latest deal was with the private credit firm Coromandel Capital and follows a previous closing earlier this year between the company and another firm. Both transactions were $50M, giving FilmHedge $100M in total lending capacity.

FilmHedge is a fin-tech company providing short-term debt financing to borrowers working in Film, TV, and media. One of the company’s services is a lending platform that provides short-term financing (up to 12 months) to producers. The system determines the terms for loan offers algorithmically, based on the production finance plan and corporate agreements. The company also offers data products which track production spending in real-time, automate performance reports for investors, and financial transaction insights previously unavailable to media investors.

Coromandel Capital provides flexible, non-dilutive growth capital via senior secured lines of credit and term loans to specialty finance and FinTech’s that otherwise do not conform to the traditional credit boxes of banks and other financial intermediaries. A true partner, as opposed to a passive check, Coromandel Capital permits its clients to earn better terms over time, as well as provides operational advisory and outsourced capital markets.

“Our mission at FilmHedge is to make media investing more efficient, faster, and more scalable. You can’t really do that if you’re a film fund, a bank, or a private equity shop. Those models require too many decision-makers to sign off on a deal, which means they are slow,” said Jon Gosier, FilmHedge’s Founder and CEO.

“This is why alternative lenders like Coromandel make great partners for us. We offer a tech-first, passive way for them to generate returns from an asset class they weren’t exposed to,” he continued.

“We are looking forward to partnering with Jon, Josh, Mickey, and the rest of the FilmHedge team in addressing the unmet financing needs within the film industry. The team has tremendous experience, robust and proprietary customer acquisition channels, as well as the savvy to effectively underwrite and mitigate risk,” said Rob McGregor, Co-Founder and Managing Partner, Coromandel Capital.

As the company’s latest institutional financing partner, Coromandel’s investment will allow the company to expand into new areas of financing supported by new features of automation.

“Our platform allows our staff to digitally underwrite films the same way a bank might. This includes analyzing pre-sale agreements, distribution agreements, completion guarantees, and legal documents. We’ve codified a lot of these documents and have features in development that will allow us to use machine learning and other fancy algorithms to greatly speed up transactions,” Gosier continued. “Faster underwriting means more qualified deals which translates to faster, and in some cases larger, returns.”

Pictures:

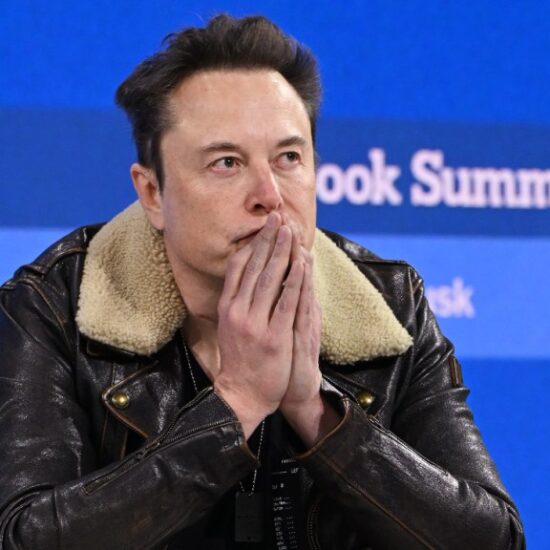

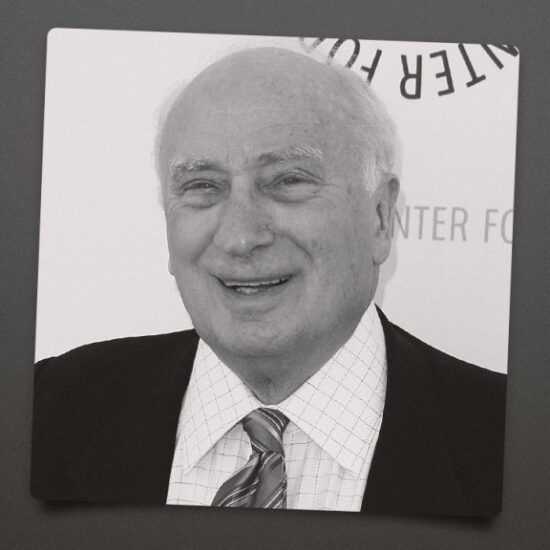

Jon Gosier CEO – Mickey Vetter co-founder at FilmHedge

Jérôme Paillard Marché du Film Executive Director – Jon Gosier

Mickey Vetter CGO – Josh Harris CFO – Jon Gosier CEO

Media Contact:

Jane Owen

+1 (323) 819-1122

jane@janeowenpr.com