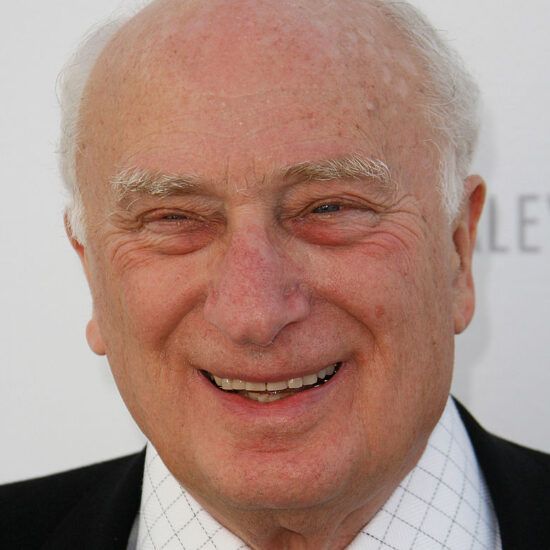

Disney is one of the most recognizable brands in the world, but Hollywood is changing. During a recent interview with CNBC, Disney CEO Bob Iger got on TV and basically said they were taking offers for various parts of their business.

This is a dramatic shift from how Bob Iger built Disney in his first stint as CEO. He was known to be the builder, someone who would acquire and create. In his tenure, he secured Pixar, Marvel, and Lucasfilm, all massively profitable brands that fall under the Disney umbrella.

But this second time around, Iger is trying to balance the checkbook.

We’ve covered this before, but Disney owns a lot of stuff!

In short, they have the following companies (along with many other subsidiaries):

- ABC

- ESPN (80% stake)

- Touchstone Pictures

- Marvel

- Lucasfilm

- A&E (50% equity holding with Hearst Corporation)

- The History Channel (50% equity holding with Hearst Corporation)

- Lifetime (50% equity holding with Hearst Corporation)

- Pixar

- Hollywood Records

- Vice Media (10% stake)

- Core Publishing

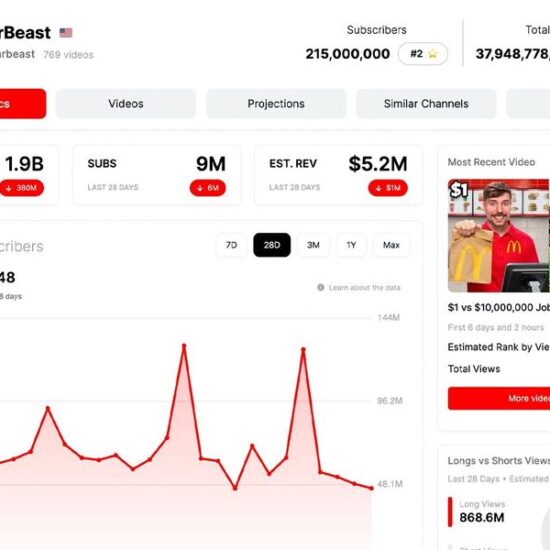

Disney is worth around $160 billion, with assets totaling around $200 billion.

But according to Bloomberg, “Iger put roughly a third of the company up for sale this week, declaring Disney’s linear TV assets noncore. That includes TV networks ABC, FX and Freeform. He also said Disney is looking for a strategic partner for ESPN—though he’s not willing to sell the whole thing—and the company is already looking to sell or restructure its TV and streaming business in India.”

So why is this all happening?

Why Is Bob Iger Considering Selling Companies?

Well, owning all this stuff can be very expensive, and the media world is getting more and more expensive. Owning a channel like ABC was very profitable in the early 2000s, but now you’re spending around $100 million on anchor salaries alone and people are drifting away from network TV. ESPN is the most recognized name in all of sports, but people don’t really watch much on it anymore except for Monday Night Football.

While strategic partnerships with Hearst were smart earlier on, Disney might have seen now as a time to unload the parts of some of these traditional TV channels.

This is a lot of overhead for a company still trying to rebound after COVID-19.

These companies, while generating income, also cost a lot of money. Again, Bloomberg reports, “Disney’s media networks generated 35 percent, or $24.8 billion, of company revenue and more than 50 percent, or $7.5 billion, of its operating income.”

Add this to the estimated $800 million streaming services are going to lose and Iger seems to see a rapidly changing industry he’s trying to get out in front of—especially now that he wants to show growth every quarter to prove a rebound after the lean COVID years.

Currently, there are no bids, but many have mused that places like Comcast, Apple, and Amazon might come in and make pushes to acquire ESPN or ABC, channels they would want to show live sports.

And channels like FX might be a nice purchase not only for their back catalog but also for prestige TV.

Iger has three more years left on his contract, and it seems like he wants to cement his legacy as a great CEO for Disney, but a fire sale where he breaks it into pieces seems like the first step in a longer plan he has not unveiled yet.

Here’s the trillion-dollar question… would Iger actually sell Disney?

Well, as I said earlier, that would cost hundreds of billions of dollars, but many have long seen Apple eyeing the huge company. They have the capital, and Iger was personal friends with Steve Jobs and deeply respects the brand.

Right now, a rumor like this is hard to believe, but the deeper we get into Iger’s strategy, the more interesting it will be to see all this play out.

Source: Bloomberg